International Brands Key - Vechery Harvey - MAXD Protected by Copyright 2023 All Rights Reserved

Have a business you want whacked?

Looking for suggestions on tax evasion?

Want to learn from a pro who doesn’t follow laws?

Trying to get away with it and you have money?

Then Harvey V’s your man...

Meet: Biz Wacker

Tax Evader Harvey V

Meet: Biz Wacker

Tax Evader Harvey V

The Problem

If you’re like some bad actors, you never met a great situation, you couldn’t crap all over.

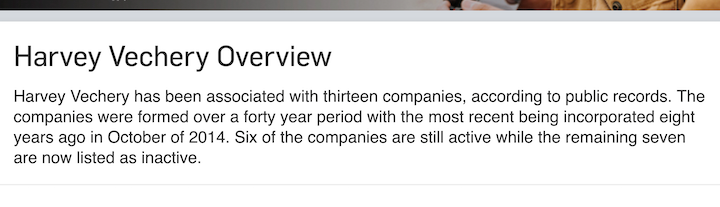

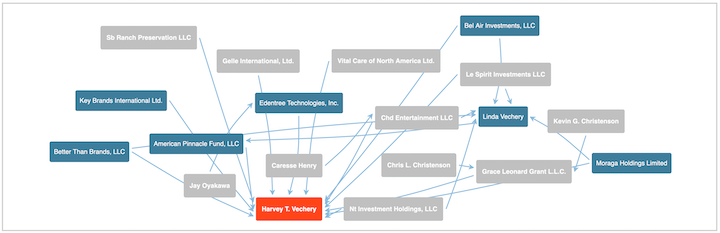

One Man, Harvey V, is really good at it. Well, Vechery is really good at getting away with it.

Of course, it helps if you got a hundred million dollars or more to piss away. That’s what Harvey V started with thanks to his ex-wife Linda.

The Harvey V Steps

2) Interfere with it until it is destroyed

4) Make every related party run away

3) Sue anybody you can with a made-up story

1) Make an Investment

5) Create a financial loss to evade taxes

Get in

Touch

Text 310-775-0058

Let's Collaborate

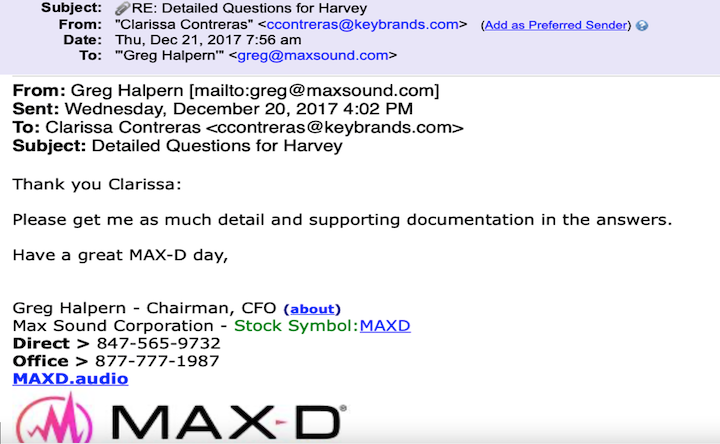

MAXD Shareholders can use the letter below the links to find out Harvey’s intentions from his various lawyers

Important Links UPDATED:

Harvey Vechery President/CEO, Key Brands International Ltd

Bloomberg

https://www.bloomberg.com › profile › person

Founded in 1974. UPDATED: The company's line of business includes the wholesale distribution of prescription drugs, proprietary drugs, cosmetics hair care and toiletries. SECTOR: Health

Harvey Vechery Archives - CDR

Chain Drug Review

https://www.chaindrugreview.com › tag › harvey-vechery

Harvey Vechery. Key Brands appoints sales and marketing director. October 11, 2017 by Chain Drug Review Harvey Vechery, JAX Premium Men's Hair Care.

doc8.txt

SEC.gov

https://www.sec.gov › Archives › edgar › data › doc8

... Harvey Vechery as Trustee and individually. By: /s/ Harvey Vechery AS FILED: THE VECHERY FAMILY TRUST, U/D/T 10/9/84.

LinkedIn · Key Brands International Ltd.

Key Brands International Ltd. | 95 followers on LinkedIn. Founded in 1974 by Linda and Harvey Vechery, Key Brands International has been instrumental in the cosmetic industry.

Season Ticket Solutions Inc. News & Articles

Crain's Chicago Business

https://www.chicagobusiness.com › Companies

... Harvey Vechery and his family's trust. Mr. Vechery is president of California-based consumer products company Key Brands International Ltd. Season Tickets ...

Linda Vechery Vs Harvey Vechery Court Records

Trellis.Law

https://trellis.law › case › linda-vechery-vs-harvey-vechery

On October 14, 2009, Vechery Linda filed a Divorce, Separation - (Family) case represented by Mannis Joseph against Vechery Harvey in the jurisdiction of Los ANGELES, CA 90404

Founded in 1974 by Linda and Harvey Vechery, Key Brands International has been instrumental in the development, launch and distribution of some of the most ...

Key Brands is the Front

https://keybrandsisafront.com/

This Key Brands page is dedicated to Harvey Vechery's decades of epic business failures and highly unethical practices. Protected By Free Speech. Main Office ...

Making Harvey Richer is a beautiful idea but Vechery is just ...

https://makingharveyricher.com

Harvey Vechery has now proven beyond any doubt that he is a total fraud... Greg Halpern gave Vechery an incredible offer that would have fixed Vechery's mess ...

MAXD Shareholders can use the letter below to find out Harvey’s intentions

October 5, 2023

ATTENTION: Attorneys for Harvey Vechery

Greetings

This letter is an inquiry to find out: 1) If Harvey Vechery is currently your client, and if so - 2) What is Mr. Vechery doing with Max Sound Corporation (MAXD.pk) since April 2023 when Vechery began publicly stating that he has been awarded control over Max Sound by removing former CEO Greg Halpern. After you consider my letter to you, maybe you can invoice to Vechery a substantial new retainer to assist him in making sense of his very weird actions.

I am a legitimate shareholder of record who has invested my own hard-earned-money at market into the Public Company MAXD.pk and in past private placements based on the significant past successes of Mr. Halpern which have yielded unmatched massive returns for investors in the Microcap markets for more than four decades.

My interest is for estate planning as one of thousands of shareholders of Max Sound Corporation. Efforts by me and other shareholders that I encouraged to invest in MAXD to reach Mr. Vechery have been futile. Vechery has been non-responsive to me and the shareholders as to fulfill his regulatory and fiduciary responsibility that he took on when he began boasting publicly in April of this year (2023) that he got the former CEO thrown out of MAXD. During the past six months, Mr. Vechery has failed grossly to even utter a word online, or to upgrade MAXD’s S.E.C. filings as to what his plan for the Company is. He has 100% legal liability to report since May 2023 with the Shareholders, the S.E.C. the I.R.S., the State of Delaware, and FINRA.

See - https://www.sec.gov/Archives/edgar/data/1353499/000147793222008789/maxd_8k.htm

Meanwhile, online recordings of Vechery have appeared, where Vechery and his associate Scott Kapp, proclaim they “got Greg Halpern kicked out of the Company and thrown out of his house.”

See https://vimeo.com/843455844 Said video is available online as are many other sites popping up that contain many issues of great concern to me as one of the thousands of shareholders. I am asking you to address these concerns since Mr. Vechery is clearly ignoring the shareholders.

The above quotes, and other Vechery and Kapp remarks, are slanderous, defamatory as well as gross distortions according to Halpern’s multiple online posturing. As a shareholder, I am certain that Mr. Vechery is engaging in bad management, however, I am more concerned that Vechery’s only point to taking over the Company, clearly appears to be for him to ensure an ill-gotten, large, personal, financial tax benefit while destroying millions of dollars of potential shareholder gains that Halpern has four-plus decades of enormous successes achieving.

Among other things, Vechery and Kapp, et al have according to Halpern, entirely ignored Halpern’s significant efforts to amicably allow, and even assist Vechery led personnel to continueon working towards the success of MAXD. We are informed by Halpern that minimal conversations have occurred between Vechery’s liaison John Braun and Halpern, yet those ended unproductively with Vechery simply going dark after Halpern made many serious efforts to try to help Vechery do anything at all with MAXD. See the valuable offers Halpern made Vechery, posted no doubt by Halpern at https://makingharveyricher.com

It is extremely bizarre that Vechery would have appeared to intentionally deceive the court to remove Halpern and then make a deliberate effort to bury the Company and its tens of millions of dollars of now lost shareholder value. Throughout the history of the company, MAXD enjoyed staggering market liquidity of over $243 million dollars, while achieving documented market caps on multiple occasions in excess of $52 million and $100+ million dollars respectively.

At first, it seems preposterous that Vechery would be online boasting how he rid the Company of its CEO while Vechery simultaneously ignores the shareholders and devotes himself to deliberately destroying MAXD.

But then, the real scheme appears to unfold, and we shareholders get to see what is really going on. In what the Department of the Treasury and the I.R.S. calls Criminal Tax Evasion, Vechery appears to have offset part of a huge gain in 2022 of close to $30 million dollars by writing off millions of dollars invested with MAXD and Greg Halpern.

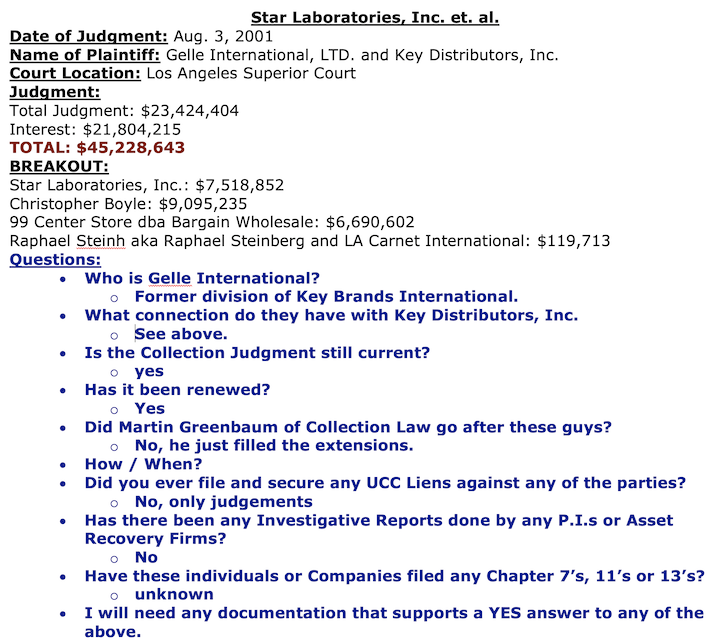

Halpern, and his experts, advise that Vechery’s scheme is blatant white-collar-crime, and a serious conflict of interest that offers Government Regulators and MAXD shareholders significant relief under Reg 10b and illegal tax evasion among other potential rule violations. Further, Halpern provides a review of several other Companies Vechery has used the same M.O. on, and up until now, he’s gotten away with it. There are many examples to choose from but let’s start here – https://casetext.com/case/runflatamerica-llc-v-malkasian

I am not a lawyer but like many of MAXD’s shareholders, I have more than enough investment experience and savvy to see a Method of Operation when it is right in front of me. Take this excerpt about Vechery from the above case just to get a feel for something that deeply concerns me and other shareholders whom I encouraged to invest in MAXD when Halpern was in charge –

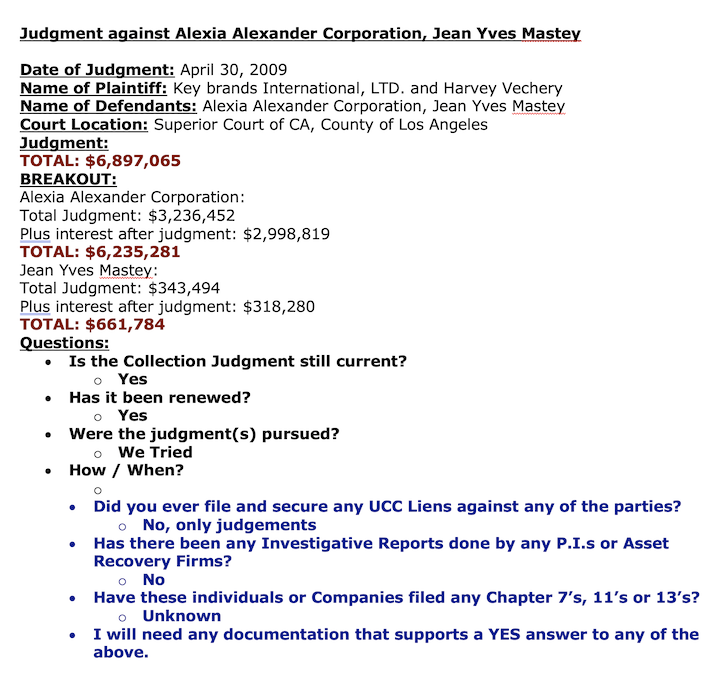

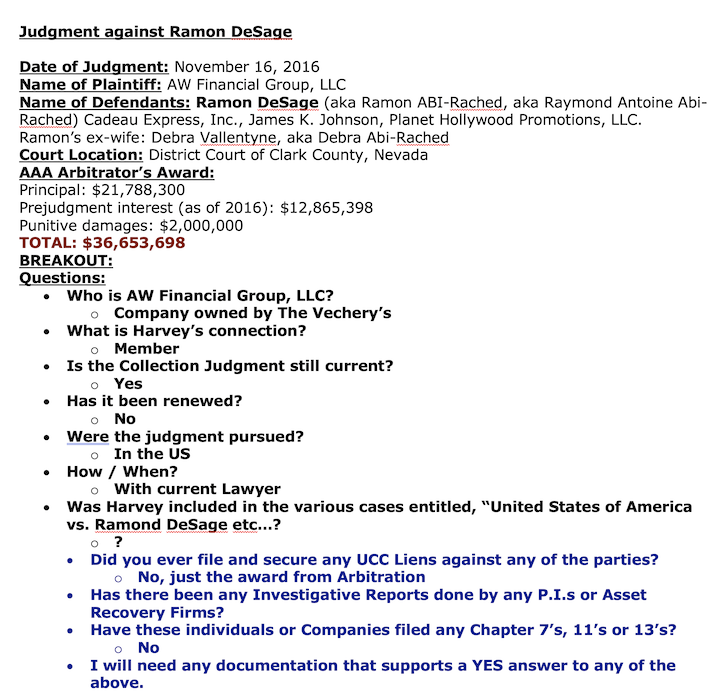

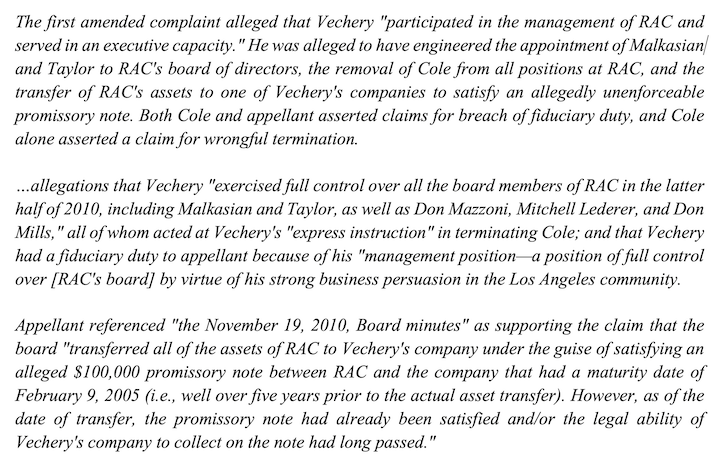

The first amended complaint alleged that Vechery "participated in the management of RAC and served in an executive capacity." He was alleged to have engineered the appointment of Malkasian and Taylor to RAC's board of directors, the removal of Cole from all positions at RAC, and the transfer of RAC's assets to one of Vechery's companies to satisfy an allegedly unenforceable promissory note. Both Cole and appellant asserted claims for breach of fiduciary duty, and Cole alone asserted a claim for wrongful termination.

…allegations that Vechery "exercised full control over all the board members of RAC in the latter half of 2010, including Malkasian and Taylor, as well as Don Mazzoni, Mitchell Lederer, and Don Mills," all of whom acted at Vechery's "express instruction" in terminating Cole; and that Vechery had a fiduciary duty to appellant because of his "management position—a position of full control over [RAC's board] by virtue of his strong business persuasion in the Los Angeles community. Appellant referenced "the November 19, 2010 Board minutes" as supporting the claim that the board "transferred all of the assets of RAC to Vechery's company under the guise of satisfying an alleged $100,000 promissory note between RAC and the company that had a maturity date of February 9, 2005 (i.e., well over five years prior to the actual asset transfer). However, as of the date of transfer, the promissory note had already been satisfied and/or the legal ability of Vechery's company to collect on the note had long passed."

My entire point is this is a common effect of Vechery’s M.O. because it is clear he has lost alot of his estate money trying to make up his own set of rules.

Anyway, most of the content in this letter was provided to me when I reached out recently to Mr. Halpern to ask what was going on at the company since April of this year. Halpern stated that he is no longer in charge of Max Sound since April 2023 when Mr. Vechery got a court order to remove Halpern and give Vechery control of the company.

Halpern stated that he has posted a template of this letter online. He went on to say he is directing shareholders of Max Sound that are calling him to inquire to review the website https://makingharveyricher.com and then if we as shareholders feel it appropriate, to adapt this template letter and send it to various attorneys of record that Mr. Vechery may still be working with in Securities Law (S.E.C.), Tax Accounting Law (Department of the Treasury of the I.R.S.), Bankruptcy Law and Contract Law. You may therefore receive several of these letters from other Max Sound shareholders as well.

Among other things, Vechery appears to have falsely removed Halpern on the basis that he claims Halpern was looting the company and using it as a personal piggy bank. Halpern documents in his numerous public disclosures with the S.E.C. that he has put millions of dollars into the company and operated at the Company until April 2023 with no compensation whatsoever for at least the previous five years and that it was documented that Vechery was all too familiar with that fact.

We are informed that Harvey Vechery, Scott Kapp, Bill Woodward, Jeff Stowers, John Braun, Alfred Hildebrand, Erez Barak, Billy Huddleston, Kurt Benjamin, Grace Roeder, Devine Mafa, Chris Christianson and several others of their questionable associates were involved in the company on a day-to-day basis for at least the previous six years according to Halpern’s AT&T record demonstrating 14,000+ calls by Vechery to Halpern. Even when Mr. Halpern had to terminate Harold Blaisure for lying on his New Officer Disclosure to the S.E.C., Vechery continued to work with Blaisure and in fact Vechery is recorded creating rumors that Blaisure will be appointed to take over MAXD.

More importantly, Vechery received annual audited publicly disclosed financial statements from the S.E.C. website throughout the time periods in question as did all shareholders, but Vechery also received up to the minute financial reports from Halpern, at Vechery’s continued requests over and above what we as shareholders received through regulatory filings at the S.E.C. Further, Halpern has supplied email communications showing that Vechery received 17 “Use of Proceeds” to compare against all uses of capital by Halpern at MAXD.

The point being, Vechery had to know it would be impossible to have looted the Company because there was nothing to loot according to the massive inventory of publicly available audited records and those especially received by Vechery and Kapp.

Halpern points out over and over that Vechery did not like to follow any rules and repeatedly ignored Halpern’s urging to disclose Vechery’s insider status until Vechery’s Securities Attorney finally filed his 13D Insider Reports many years later than required by the S.E.C.

Ironically, then Vechery states that Halpern was malfeasant and had no outside directors to provide oversight. Halpern makes the case online that more than 95% of Fully Reporting Pink Sheet Companies Do Not Have Outside Directors and that a million-dollar Directors and Officers Insurance policy that MAXD could neither secure nor afford, would be a pre-requisite to any legitimate members joining such a Board.

Halpern goes on to make the case that his millions of hard dollars invested in MAXD yielded him non-negotiable Preferred Shares and Super Majority control the exact same way Larry Page and Sergei Brin set up their investment in GOOG. Halpern points out that his ownership position was acquired with a seven-figure, debt-to-equity conversion during a 2018 Google hostile takeover attempt and according to Delaware Law Super Majority doesn’t require the holder to seek oversight. Halpern demonstrates that Vechery was intimately involved in every aspect of his personal and professional business.

Mr. Halpern appears hell-bent on making the point that Mr. Vechery knowingly and fraudulently removed Halpern due only to a personal vendetta and a now documented four decades history of Vechery purposely ruining his own investments to take large tax losses and evade certain tax responsibilities. See - https://BizWackerTaxEvadorHarvey.com

This much is clear according to Mr. Vechery and Mr. Kapp. Since taking over MAXD in April, the two are recorded telling people they got Halpern removed and they're in charge. So, if Vechery et al is in charge, it begs the question - what are they in charge of and what are they doing since they have made no effort to reach out to Mr. Halpern. They’ve let the Delaware Corporation dissolve leaving even a six-hundred-dollar renewal credit prepaid by Halpern, and they’ve failed to update any S.E.C. filings whatsoever as required by law.

Halpern makes his case online demonstrating with hard documentation and recordings that Vechery has made no effort whatsoever to keep MAXD in business or to reach out to Halpern or respond to Halpern’s various offers.

Shareholders like me are now asking the tough questions. Where is Vechery’s oversight on his actions at the company since Vechery alleged against Halpern a total lack of oversight? Let’s revisit again the much bigger shareholder concern - Halpern’s states that Vechery took a tax loss of millions of dollars on his personal family estate trust tax return against the loss of the Company which Vechery himself caused.

Also of great interest, in Halpern’s 2022 Personal Bankruptcy Final Signed Global Settlement Agreement with the Federal Court, Vechery happily signed off agreeing that Halpern will retain his Delaware Super Majority Preferred MAXD Controlling Shares. In exchange, Halpern left Vechery a $900,000 dollar bankruptcy exemption and Halpern’s $2,000,000 personal home equity. Yet, then Vechery sues to remove Halpern at the absolute cost of my investment, Halpern’s seven figures of investments in the Company, and thousands of other MAXD shareholders, totaling many millions of dollars. Oddly, Vechery is also on record many times telling Halpern he is glad Halpern will keep his control shares in MAXD.

It seems obvious that Vechery’s goal was to commandeer MAXD, intentionally destroy it, then wrongly evade millions of dollars of tax, regardless of the harm to thousands of shareholders who have legitimately invested in the company. As of this past May, Vechery had an absolute responsibility to file an 8K and update MAXD’s going forward plan as was promised by previous management in November of 2022.

See - https://www.sec.gov/Archives/edgar/data/1353499/000147793222008789/maxd_8k.htm

Vechery is not entitled to destroy the company to help himself financially by evading tax liability at the expense of me and the rest of the shareholders after wrongly removing the principal Halpern.

Halpern himself has millions at stake and his only interest clearly was and still is the success of MAXD. Here are a few final thoughts about the situation at hand –

According to Greg Halpern - Harvey Vechery waged a Cyberstalking campaign against Mr. Halpern over the past couple years. Halpern has presented plenty of proof and as a legitimate shareholder it seems obvious that this happened and contributed greatly to the damage to my investment and all the shareholders. At one of the Halpern portals, Ballard Spar does some analysis of the recent groundbreaking appellate court Cyberstalking precedent and how it affected a recent challenge by the defendant that led to enormous fines and a 3½ year jail sentence now being served.

https://www.ballardspahr.com/insights/alerts-and-articles/2022/06/third-circuit-upholds-federalcyberstalking-statute-against-constitutional-challenge

Halpern has demonstrated his ability to remove all of the Vechery inspired online defamation here two years after their first release, and Halpern is completing such removal now that he has copied all of the videos related thereto for future proof and shareholder action if pursued. Vechery filed his case that removed Halpern from MAXD quite coincidentally by pointing to the defamations Vechery helped invent in direct parallel with Alfred Hildebrand who posted the phony video content being removed from YouTube now. Using a shill as a plaintiff, Hildebrand then cloned the phony lawsuits which were ultimately dismissed. Of great relevance, Vechery neither asked for nor received any monetary damages in his action that removed Halpern from the Company.

To respond to all of this Vechery chicanery, Halpern challenged Vechery by comparing Halpern’s 45 years of immense global successes against Vechery’s 40 years of massive personal as well as professional failures in nearly everything. There will be many more Halpern wins posted over the next several years according to Halpern that are being matched side-by-side against Vechery’s horrific losses of over 100 million dollars reported to Halpern by Vechery.

Halpern suggests to shareholders, media, etc, if there is any doubt at all who is the good guy and

who is the villain - go and review – (for Halpern)

https://BattleTestedWinner.com https://InventorOfCrowdFunding.com https://ChannelGreg.com

and (for Vechery)

https://therealharvey.com https://hoodwinkersexposed.com https://bewareofrottenharvey.com

https://keybrandsisafront.com/ https://makingharveyricher.com

Halpern worked on the original algorithm that let to Alta Vista and now Google search

optimization. He now points to simple searches on Google for Harvey Vechery as a sample of how

he intends to expose Mr. Vechery. See –

https://www.google.com/search?q=harvey+vechery&client=safari&sca_esv=573472004&source=hp&ei=vL0qZfj1ArzMkPIP_4Ka-A4&iflsig=AO6bgOgAAAAAZSrLzBfGaxg-2ALddwGi_eEyvKH-2GWf&ved=0ahUKEwj4w_rs9vWBAxU8JkQIHX-BBu8Q4dUDCAs&uact=5&oq=harvey+vechery&gs_lp=Egdnd3Mtd2l6Ig5oYXJ2ZXkgdmVjaGVyeTIFEAAYgAQyBRAAGIAEMgUQABiABDIGEAAYFhgeMggQABiKBRiGA0iUHlDeBVieGXABeACQAQCYAcQBoAGcEaoBBDAuMTS4AQPIAQD4AQGoAgrCAhAQABgDGI8BGOUCGOoCGIwDwgIQEC4YAxiPARjlAhjqAhiMA8ICERAuGIAEGLEDGIMBGMcBGNEDwgILEAAYigUYsQMYgwHCAgsQABiABBixAxiDAcICFBAuGIAEGLEDGIMBGMcBGNEDGNQCwgILEC4YgAQYsQMYgwHCAgQQABgDwgIOEC4YigUYsQMYgwEY1ALCAggQLhiABBixA8ICBRAuGIAEwgIOEC4YgAQYsQMYgwEY1ALCAg4QLhiABBixAxjHARjRA8ICDhAuGIMBGNQCGLEDGIAEwgIREC4YigUYsQMYgwEYxwEY0QPCAggQABiABBjJA8ICCxAuGIAEGMcBGK8BwgIIEAAYgAQYsQPCAhEQLhiKBRixAxiDARjHARivAcICCxAuGIMBGLEDGIAEwgILEC4YgAQYxwEY0QPCAgsQABiABBixAxjJA8ICBxAAGIAEGAo&sclient=gws-wiz

One thing is very clear. The current shareholders are not being represented at all. In fact, in Mr.Vechery’s hands, we the shareholders will lose our complete investment in a company that still has plenty of life to give. Thank you for reviewing my concerns. If you represent Mr. Vechery, Mr. Kapp, or their interests, please advise whether your client has any plan for MAXD as is their fiduciary responsibility.

Sincerely,

MAXD Shareholders can email the letter above to Harvey’s attorneys here

Tom Lallas Esq <tlallas@lsl-la.com>

Larry Russ Esq <lruss@raklaw.com>

Kathryn Catherwood Esq <kcatherwood@grsm.com>

Laura Anthony Esq <lanthony@anthonypllc.com>

Timothy Baumann Esq <tbaumann@raklaw.com>

Ali Soltani Esq <ali@ritmomundo.com>